Click here for Rural Press Release

Click here for Rural Market Report

Click here for All Farm Price Index

Click here for Lifestyle Press Release

Data released today by the Real Estate Institute of New Zealand (REINZ) shows there were 142 fewer farm sales (-37.1%) for the three months ended December 2023 than for the three months ended December 2022.

Overall, there were 241 farm sales in the three months ended December 2023, compared to 195 farm sales for the three months ended November 2023 (+23.6%), and 383 farm sales for the three months ended December 2022.

1,059 farms were sold in the year to December 2023, 499 less than were sold in the year to December 2022, with 41.2% fewer Dairy farms, 7.3% less Dairy Support, 32.3% less Grazing farms, 35.1% less Finishing farms and 26.3% less Arable farms sold over the same period.

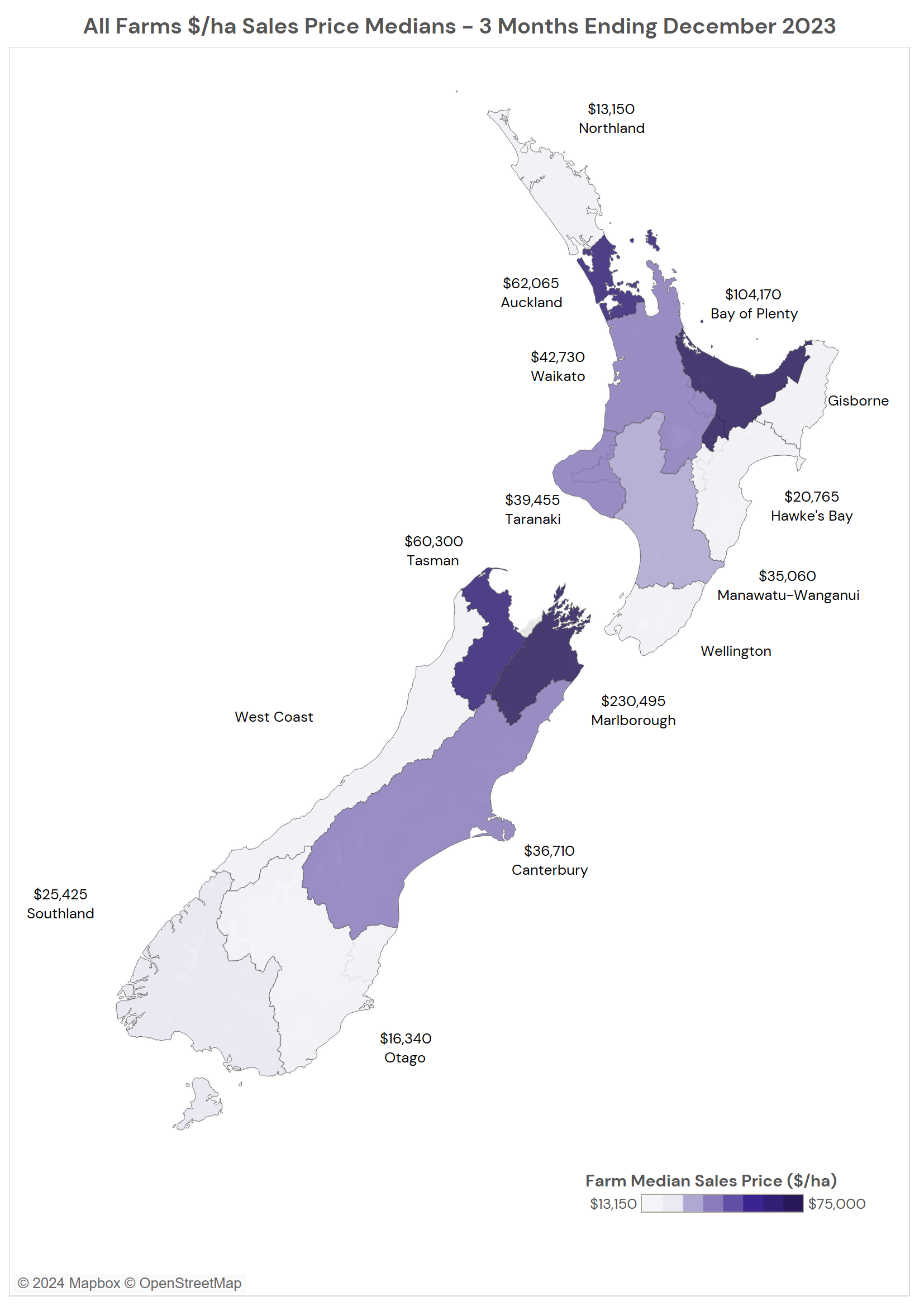

The median price per hectare for all farms sold in the three months to December 2023 was $33,960 compared to $33,440 recorded for the three months ended December 2022 (+1.6%). The median price per hectare increased 2.2% compared to November 2023.

Shane O’Brien, Rural Spokesman, at REINZ says while the year result was anticipated by the industry, we are seeing a substantial reduction in the volume of sales throughout 2023.

“This reduction, especially when compared to previous years, has affected all regions and sectors for varying reasons.”

“There is no doubt the head winds from farm product prices combined with on-farm interest rates (circa 8.0%) and rising on-farm inflation has challenged buyers when looking at property options,” comments O’Brien.

“For the first time in several years a considerable number of properties remained unsold at the end of the Spring selling season in 2023. Buyers are being cautious and considered with buying decisions, but buyers indicated they will pay for the “right” property. The depth of the buyer pool has been reduced due to the lack of the right listings for active buyers.”

“The dairy sector had 57 dairy sales across New Zealand in December 2021 which reduced to 42 sales in December 2022 but only 14 sales of dairy farms across all of New Zealand in December 2023.”

“As you can see there has been a significant drop. Similar sale trends have occurred in other sectors including grazing properties that have missed out on any active buyers who see an opportunity for conversion say to forestry,” says O’Brien.

The REINZ All Farm Price Index decreased 2.1% in the three months to December 2023 compared to the three months to November 2023. Compared to the three months ending December 2022 the REINZ All Farm Price Index decreased 13.5%. The REINZ All Farm Price Index adjusts for differences in farm size, location, and farming type, unlike the median price per hectare, which does not adjust for these factors.

One region recorded an increase in the number of farm sales for the three months ended December 2023 compared to the three months ended December 2022, that being Auckland (+3 sales). Manawatu-Whanganui ( -28 sales) and Southland ( -23 sales) recorded the biggest decreases in sales. Compared to the three months ended November 2023, 9 regions recorded an increase in sales, the most notable being Waikato (+14 sales) and Canterbury and Otago (+11 sales).In December 2023, Finishing farms accounted for a 33% share of all sales. Grazing farms accounted for 20% of all sales, Dairy farms accounted for 15% of all sales and Dairy Support farms accounted for 12% of all sales. These four property types accounted for 80% of all sales during the three months ended December 2023.

Dairy Farms

For the three months ended December 2023, the median sales price per hectare for dairy farms was $41,020 (37 properties), compared to $36,650 (27 properties) for the three months ended November 2023, and $44,055 (80 properties) for the three months ended December 2022.

The median price per hectare for dairy farms has decreased 6.9% over the past 12 months. The median dairy farm size for the three months ended December 2023 was 128 hectares.

On a price per kilo of milk solids basis, the median sales price was $43.30 per kg of milk solids for the three months ended December 2023, compared to $40.84 per kg of milk solids for the three months ended November 2023 (+6%), and $39.78 per kg of milk solids for the three months ended December 2022 (+8.9%).

The REINZ Dairy Farm Price Index increased 3.5% in the three months to December 2023 compared to the three months to November 2023. Compared to December 2022, the REINZ Dairy Farm Price Index decreased 11.7%.

The REINZ Dairy Farm Price Index adjusts for differences in farm size and location compared to the median price per hectare, which does not adjust for these factors.

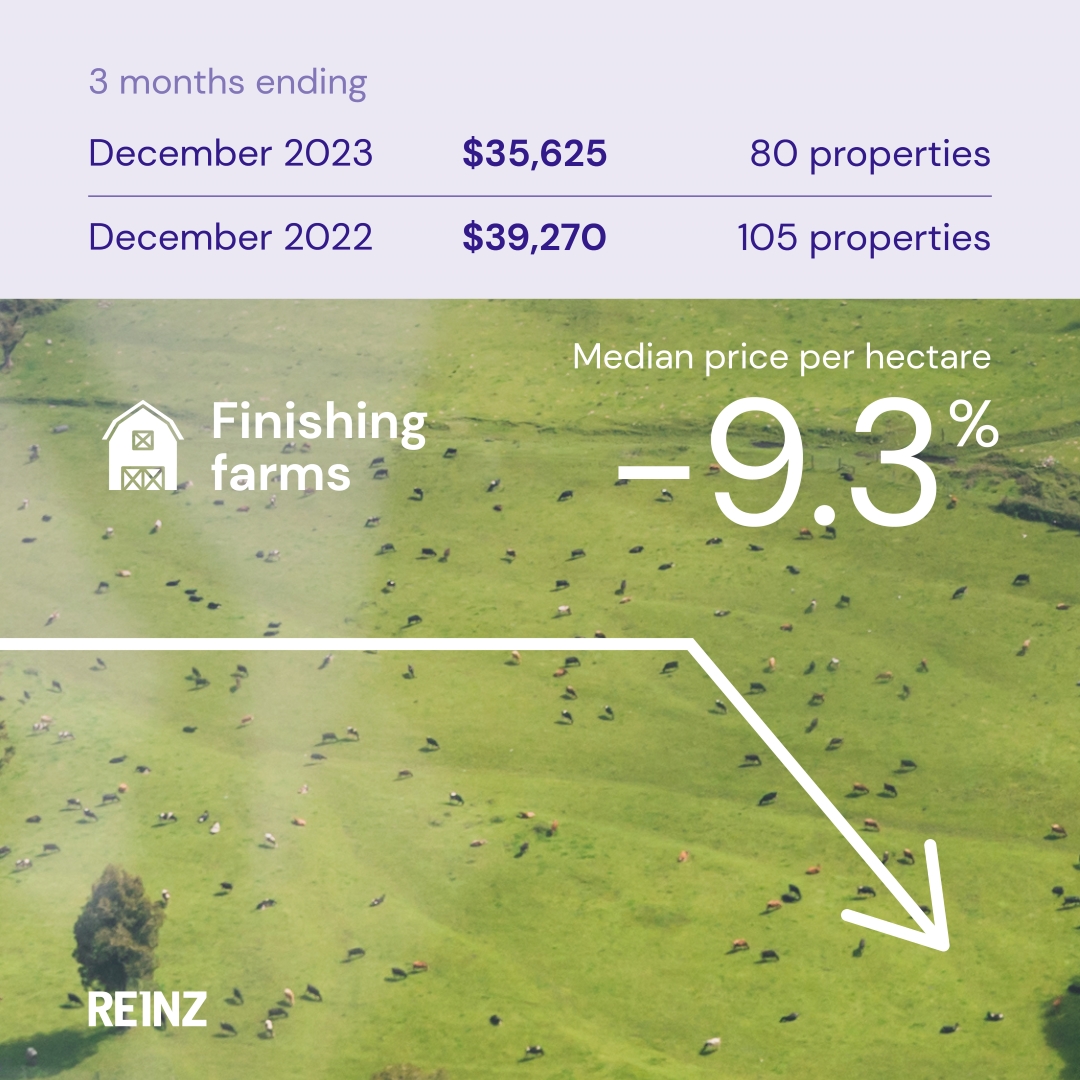

Finishing Farms

For the three months ended December 2023, the median sale price per hectare for finishing farms was $35,625 (80 properties), compared to $38,345 (74 properties) for the three months ended November 2023, and $39,270 (105 properties) for the three months ended December 2022.

The median price per hectare for finishing farms has decreased 9.3% over the past 12 months. The median finishing farm size for the three months ended December 2023 was 37 hectares.

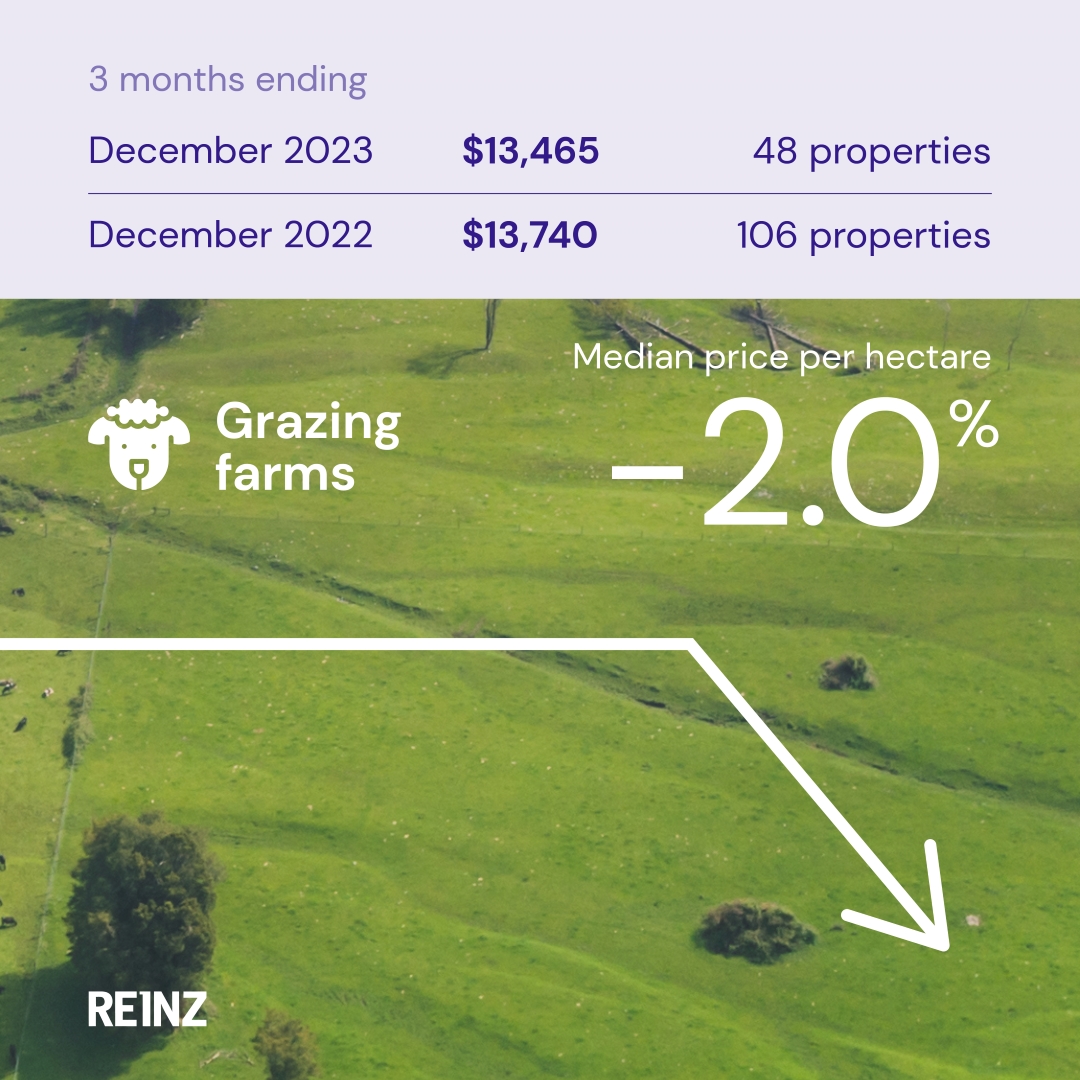

Grazing Farms

For the three months ended December 2023, the median sales price per hectare for grazing farms was $13,465 (48 properties), compared to $11,965 (38 properties) for the three months ended November 2023 and $13,740 (106 properties) for the three months ended December 2022.

The median price per hectare for grazing farms has decreased 2.0% over the past 12 months. The median grazing farm size for the three months ended December 2023 was 127 hectares.

Horticulture Farms

For the three months ended December 2023, the median sales price per hectare for horticulture farms was $228,970 (15 properties), compared to $231,150 (14 properties) for the three months ended November 2023 and $378,295 (26 properties) for the three months ended December 2022.

The median price per hectare for horticulture farms has decreased 39.5% over the past 12 months. The median horticulture farm size for the three months ended December 2023 was ten hectares.