Click here for Rural Press Release

Click here for Rural Market Report

Click here for All Farm Price Index

Click here for Lifestyle Press Release

According to data released today by the Real Estate Institute of New Zealand (REINZ), there were 142 less farm sales (-38.4%) for the three months ended January 2024 than the same period in January 2023. Overall, there were 228 farm sales in the three months ended January 2024, compared to 243 farm sales in the three months ended December 2023 (-6.2%), and 370 farm sales for the three months ended January 2023.

In the year to January 2024, 919 farms were sold. This was 475 less fewer than in the year to January 2023, with 43.7% fewer Dairy farms, 7.1% fewer Dairy Support, 37.8% fewer Grazing farms, 35.3% fewer Finishing farms and 26.1% fewer Arable farms sold during the same period.

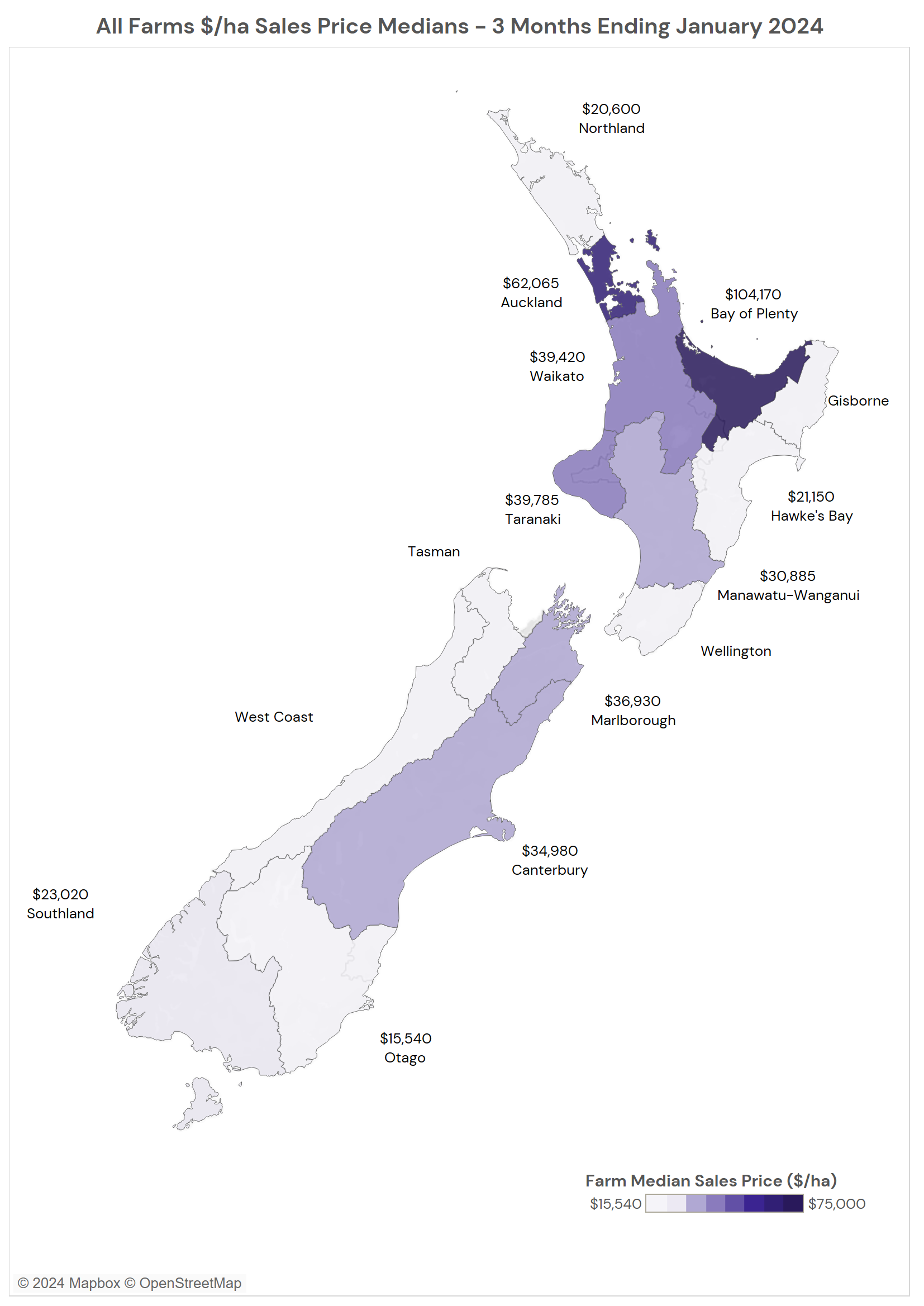

The median price per hectare for all farms sold in the three months to January 2024 was $30,940, down from $32,895 recorded for the three months ended January 2023 (-5.9%). The median price per hectare fell 8.9% from December 2023.

The REINZ All Farm Price Index rose 1.2% in the three months to January 2024 compared to the three months to December 2023. In comparison to the three months ended January 2023, the REINZ All Farm Price Index fell by 10.1%. The REINZ All Farm Price Index takes into account the differences in farm size, location, and farming type, but the median price per hectare, does not adjust for these factors.

One region saw a rise in the number of farm sales for the three months ended January 2024 compared to the three months ended January 2023, with the most notable being Auckland (+1 sales) and Northland ( -2 sales). Manawatu-Wanganui ( -25 sales) and Taranaki ( -20 sales) recorded the largest decreases in sales. Compared to the three months ended December 2023, three regions recorded an increase in sales, the most notable being Northland (+6 sales) and Southland (+4 sales).

Shane O’Brien, Rural Spokesman, at REINZ says: “The market has continued its downward trend as volumes of sales recorded dips again during the first month of 2024. It is particularly noticeable in the dairy sector, when in January 2022 there were 123 recorded dairy farm sales, but this reduced to 86 sales in 2023 and reduced by 50% again to just 43 sales this year. It is interesting to note that half the recorded sales were in the Waikato region with Southland, Canterbury and Taranaki also recording a number of sales. Dairy support farm sales volumes are back slightly also on previous years.

The reduced dairy payout plus rising farm costs and the higher interest rates are causing dairy farm buyers to take a cautious approach with many farmers focused on farm operating costs at this time. Although many farmers are buoyed by the recently announced lift in dairy payout for this season by Fonterra and encouraging results in the recent Global Dairy Trade auctions, this is yet to transpire in an increase in sales activity so far this year.”

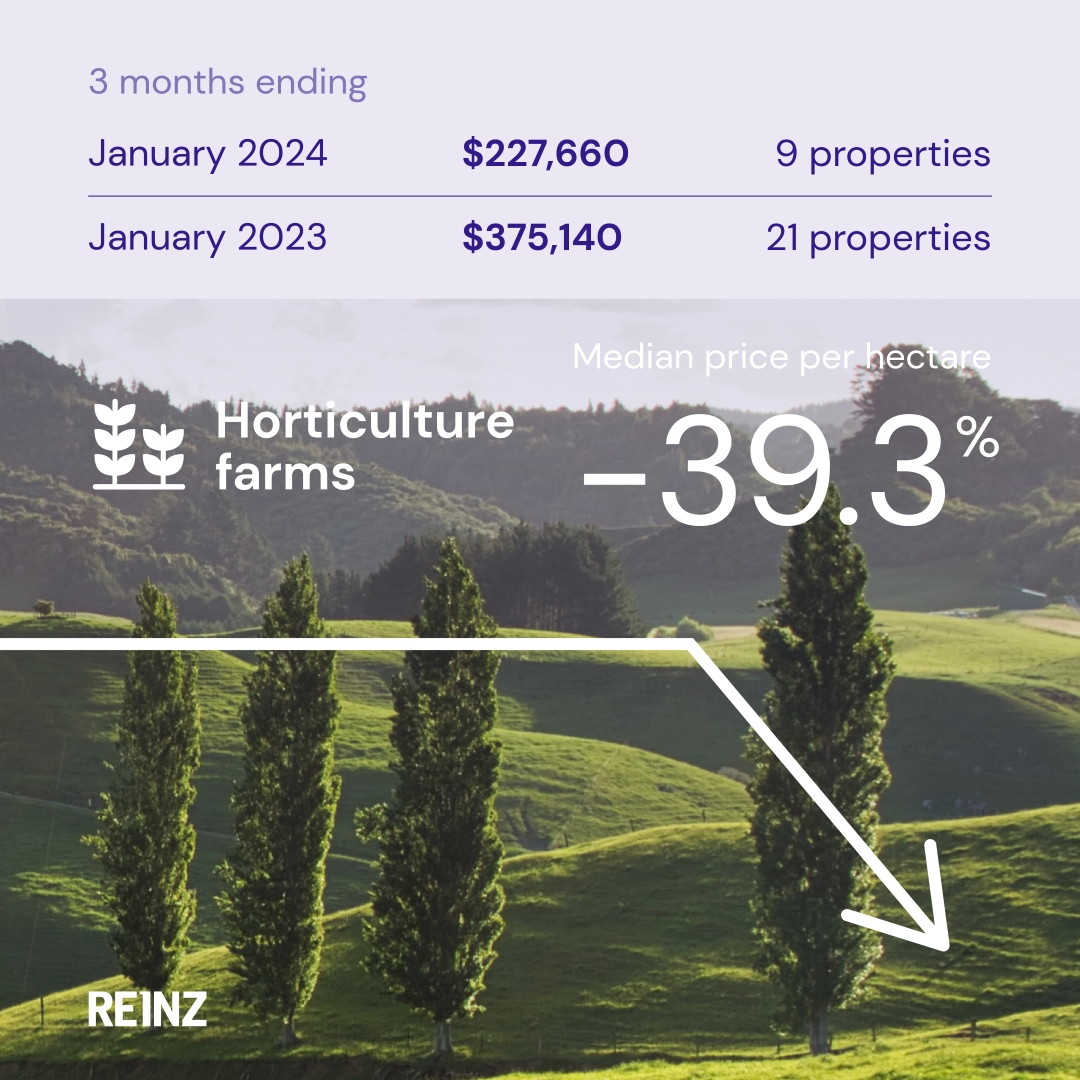

Another area to record a sharp decline is horticultural properties with 46 sales recorded in January 2022 which reduced in 2023 to 21 sales and fell sharply this year to just 9 sales across the country in January. Headwinds in the avocado and kiwifruit industries were impacting buying decisions.

The traditional sheep and beef farm markets have also not escaped buyers’ reluctance, with just 124 finishing and grazing property sales recorded for the month of January back from 202 in 2023 and down significantly from the recorded 266 sales in January 2022.

“There remains a number of properties on the market from Spring 2024 plus some new Autumn 2024 listings giving the limited pool of buyers a good selection of properties across New Zealand. With the suggestion of potential interest rate rises and a continuation of poor farm product prices and dry weather conditions setting in, there appears little likelihood of sales volumes picking up dramatically in coming months.”

In January 2024, finishing farms accounted for a 30% share of all sales. Grazing farms accounted for 24% of all sales, dairy farms accounted for 19% of all sales and Dairy Support farms accounted for 9% of all sales. These four property types accounted for 82% of all sales during the three months ended January 2024.

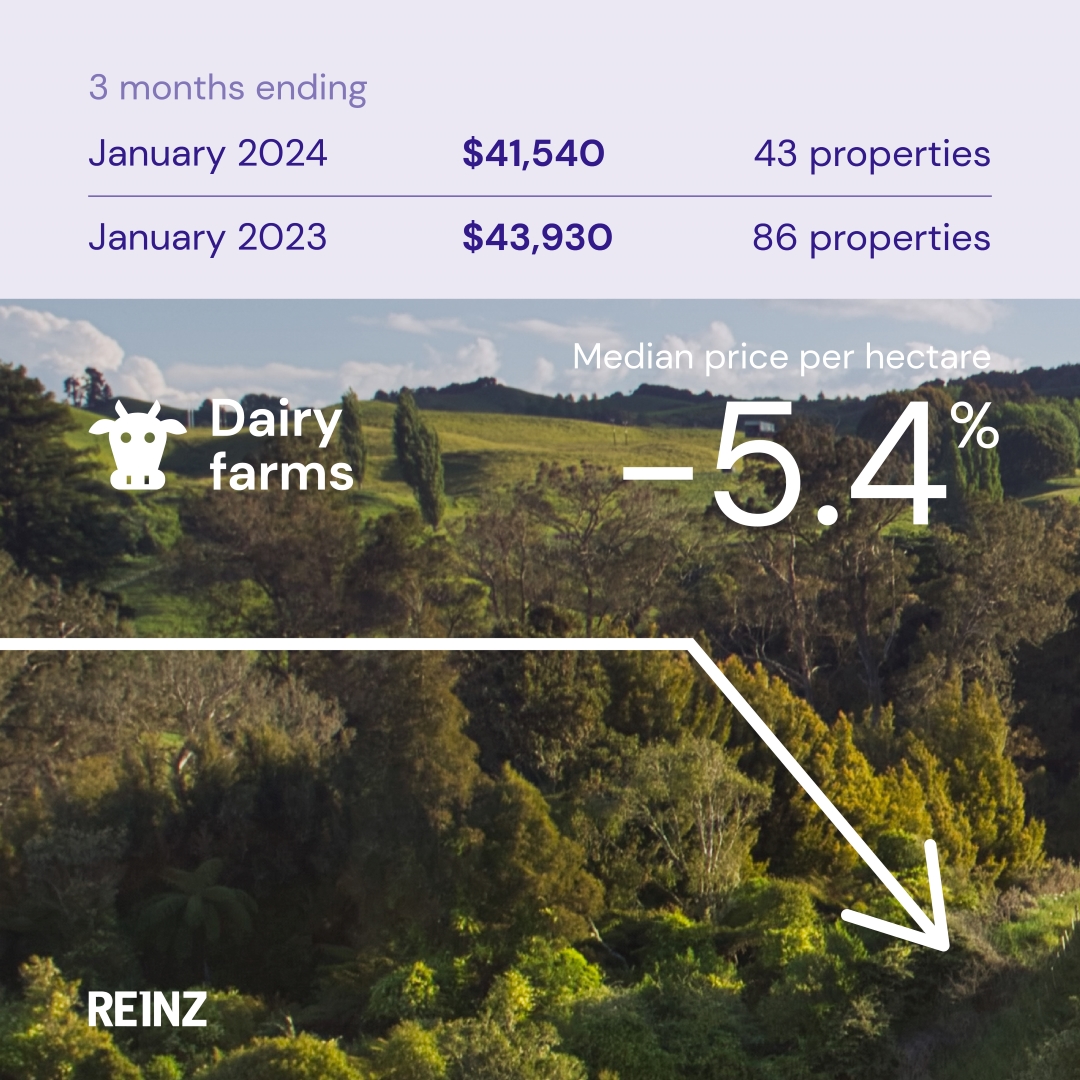

Dairy Farms

For the three months ended January 2024, the median sales price per hectare for dairy farms was $41,540 (43 properties), compared to $41,020 (37 properties) in the three months ended December 2023, and $43,930 (86 properties) in the three months ended January 2023. Over the last 12 months, the median price per hectare for dairy farms declined by 5.4%. The median dairy farm size in the three months ended January 2024 was 128 hectares.

In terms of price per kilo of milk solids basis, the median sales price was $38.39 per kg of milk solids for the three months ended January 2024, compared to $43.30 per kg of milk solids for the three months ended December 2023 (-11.3%), and $40.26 per kg of milk solids for the three months ended January 2023 (-4.6%).

The REINZ Dairy Farm Price Index rose 2.9% in the three months to January 2024 compared to the three months to December 2023. Compared to January 2023, the REINZ Dairy Farm Price Index fell 2.7%. The REINZ Dairy Farm Price Index takes into account the differences in farm size and location, unlike the median price per hectare, which does not.

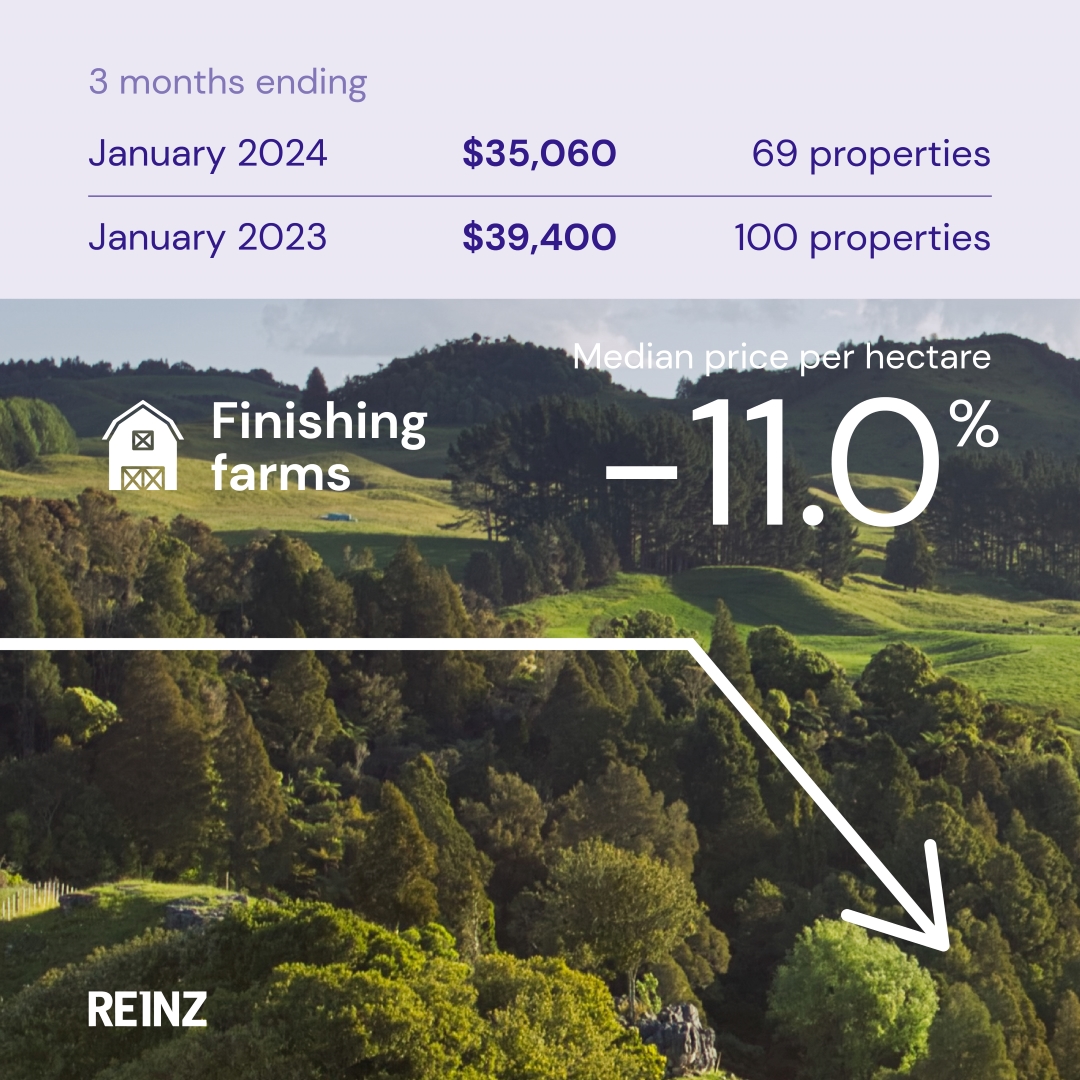

Finishing Farms

The median sales price per hectare for finishing farms for the three months ended January 2024 was $35,060 (69 properties). This was lower than the $35,920 (81 properties) for the three months ended December 2023, and $39,400 (100 properties) for the three months ended January 2023. Over the previous 12 months, the median price per hectare for finishing farms dropped by 11.0%. For the three months ended January 2024, the median finishing farm size was 36 hectares.

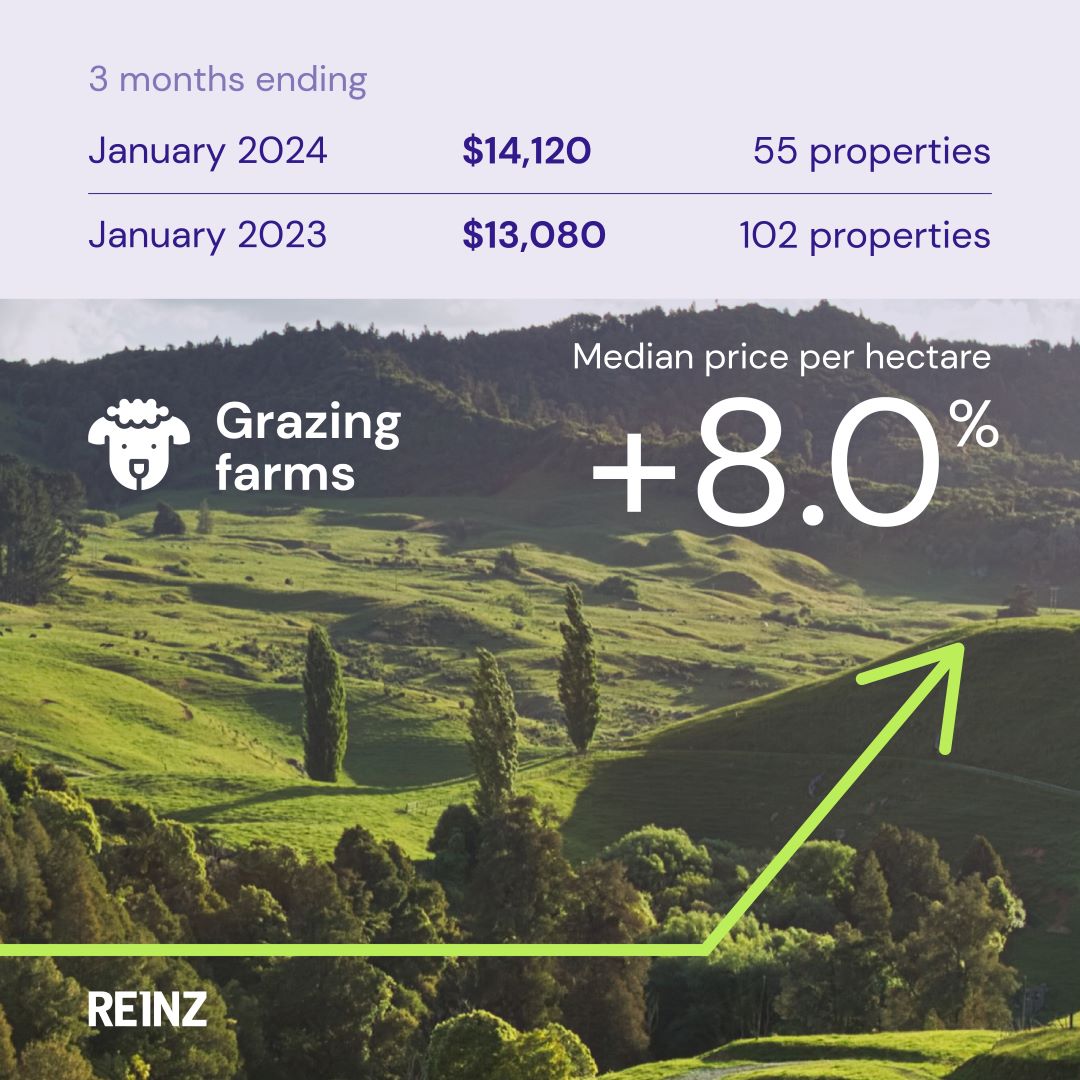

Grazing Farms

The median sales price per hectare for grazing farms for the three months ended January 2024 was $14,120 (55 properties), compared to $13,465 (48 properties) for the three months ended December 2023 and $13,080 (102 properties) for the three months ended January 2023. Over the previous 12 months, there was an 8.0% increase in the median price per hectare for grazing farms. For the three months ended January 2024, the median grazing farm size was 128 hectares.

Horticulture Farms

The median sales price per hectare for horticulture farms for the three months ended January 2024, was $227,660 (9 properties). This was lower than the $228,970 (15 properties) for the three months ended December 2023 and $375,140 (21 properties) for the three months ended January 2023. Over the previous 12 months, the median price per hectare for horticulture farms went down by 39.3%. For the three months ended January 2024, the median horticulture farm size was 11 hectares.